A 2026 Forecast The UAE Auto Industry Can’t Ignore: An Extra AED 150 Million A Year In Value Erosion

AI Quick Summary

The UAE auto industry shifted from a supply-constrained market to one of abundance in 2025, driven by a surge in new models and expanding inventory, particularly from Chinese manufacturers. This oversupply has led to softening prices, longer sales times, and significantly increased vehicle depreciation. Looking ahead to 2026, accelerated depreciation is projected to cause an additional annual value erosion of over AED 150 million, highlighting the urgent need for execution, speed, and inventory discipline.

This summary was generated by AI using this article’s content.

Read Next

Executive Summary

2025 will be remembered as the year the UAE auto industry stopped being supply‑constrained — and started paying for it.

After two years defined by scarcity, delayed deliveries, and elevated prices, availability in the UAE auto industry returned at speed. New model launches accelerated, Chinese manufacturers scaled rapidly, and dealer inventories expanded across almost every price bracket. Demand did grow, particularly at the premium end, but it failed to keep pace with the volume entering the market.

The result was a structural shift with lasting consequences:

- Vehicle supply outpaced buyer urgency

- Time‑to‑sale lengthened across most segments

- Pricing power softened, particularly in used cars

- Depreciation quietly became the market’s largest cost

The defining number: Looking ahead to 2026, depreciation across the UAE’s automotive ecosystem is accelerating. The increase in monthly depreciation from 1.2% to 1.3% implies an additional annual value erosion of over AED 150 million.

This figure does not represent total market depreciation in 2026, but rather the incremental annual loss driven by faster value decline — a hidden cost emerging directly from inventory pressure and softer pricing dynamics.

2026 will not be defined by growth alone. It will be defined by execution, speed, and inventory discipline.

2025: The Year Supply Took Control

2025 was expected to be a year of acceleration — faster electrification, deeper digital retail adoption, and continued demand recovery. A lot of this materialized, but the overriding theme was abundance.

Across the UAE, vehicle availability increased faster than buyer urgency. New car launches surged, particularly from Chinese manufacturers, while used‑car stock expanded as dealers rebuilt inventory after years of shortage.

Scarcity, which had masked inefficiencies in pricing and stock management, disappeared. Buyers became more selective. Listings stayed live longer. Price sensitivity increased.

“Scarcity covered a lot of inefficiency in recent years. 2025 exposed it. The market didn’t run out of buyers — it ran out of urgency.” – Craig Stevens, CEO, DubiCars

Premium Cars: Demand Up, A Key Focus Area

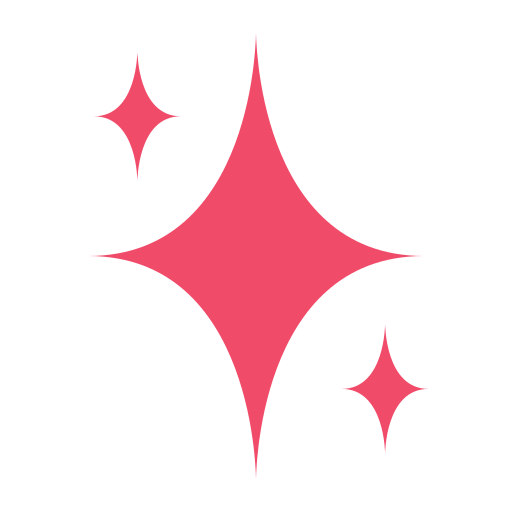

One of the clearest signals from 2025 was the industry’s move upmarket. Demand for premium vehicles priced above AED 150,000 on DubiCars grew by 40% year-on-year, confirming a decisive shift toward premium and higher‑value cars. Confidence, purchasing power, and preference all moved upward. The shift toward premium demand is further highlighted in DubiCars’ ‘The New Luxury Era’ analysis.

At the same time, premium inventory on DubiCars expanded even faster:

- AED 300,000–400,000 listings: +18.9%

- AED 700,000–1 million listings: +24.8%

- AED 1 million+ listings: +23.3%

This created a paradox. Premium demand was strong, but exposure increased. Higher‑value cars carry higher absolute depreciation, meaning every additional week unsold translated into materially higher financial risk.

Speed Becomes Strategy: The 15‑Minute Rule

In an oversupplied market, price is no longer the first differentiator. Speed is.

WhatsApp has effectively become the front door of automotive retail in the UAE. Buyers now enquire about multiple cars simultaneously and shortlist aggressively. Dealers who respond first win disproportionately.

Internal DubiCars data shows that response time — particularly within the first 15 minutes — has a direct impact on conversion.

“In this environment, speed beats price. The fastest dealer wins — not the cheapest.” – Craig Stevens

In 2026, responsiveness will no longer be an operational detail. It will be a core sales strategy.

Chinese Brands: From Disruption to Default

The most significant structural shift of 2025 was the rise of Chinese manufacturers.DubiCars added 9 new Chinese makes and 107 new Chinese models to its database in 2025 alone, with more of them expected to arrive in 2026. According to AlgoDriven, Chinese brands tripled in presence since 2022, while their share of the used‑car market grew 4x, and Chinese cars sold faster than the market average.

Key signals:

- Chinese cars captured 13% of total demand on DubiCars (up from 3% in 2024)

- Average Chinese car prices rose 14% month-on-month, and 17.3% year‑on‑year

Buyers increasingly compared brand‑new Chinese vehicles against used Japanese and European alternatives at similar price points — and often chose new. AutoData Middle East revealed that 15-17% of all new car registrations in H1 of 2025 were Chinese, and 67% of all EVs sold in the country were Chinese.

Chinese brands are no longer competing on price alone. They are competing on value density, warranty confidence, and availability — and resetting buyer expectations in the process.

EVs vs Hybrids: The Reality Check

Globally, EVs crossed 23% of passenger car sales in 2025. In the UAE, adoption continued — but at a measured pace.As stated by AutoData Middle East, EVs made up 7.7% of the UAE car market in H1 of 2025, up from 6% in 2024. Infrastructure expanded, choice increased, but resale confidence and charging behaviour moderated adoption.

The surprise winners were hybrids.

Hybrid listings on DubiCars doubled year‑on‑year, and model availability increased by over 54%. For many UAE buyers, hybrids delivered electrification benefits without lifestyle compromise. The message from the market was clear: the EV transition will not be linear.

2026 Outlook: When Small Percentages Become Big Money

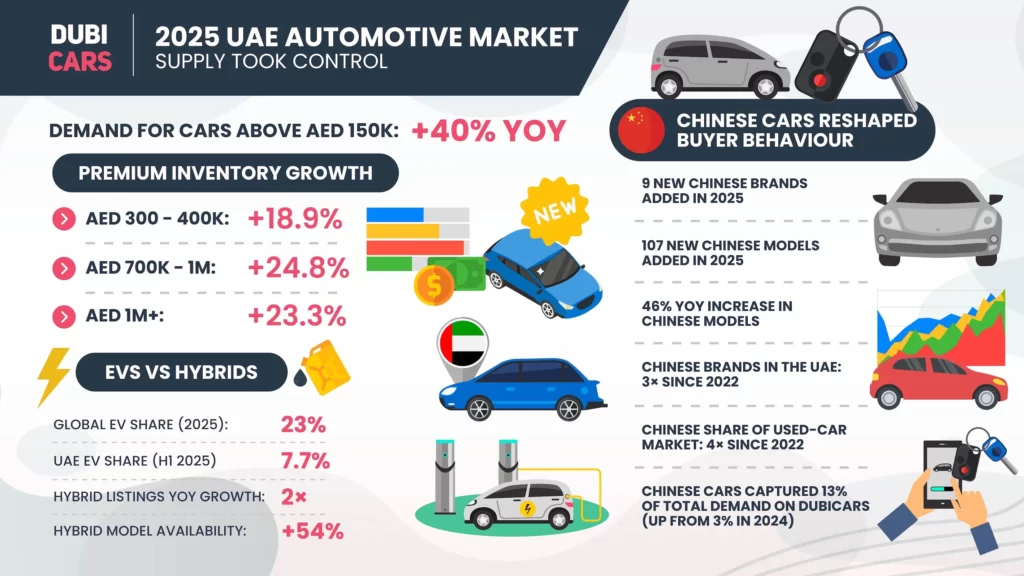

The biggest risk heading into 2026 is accelerating depreciation.

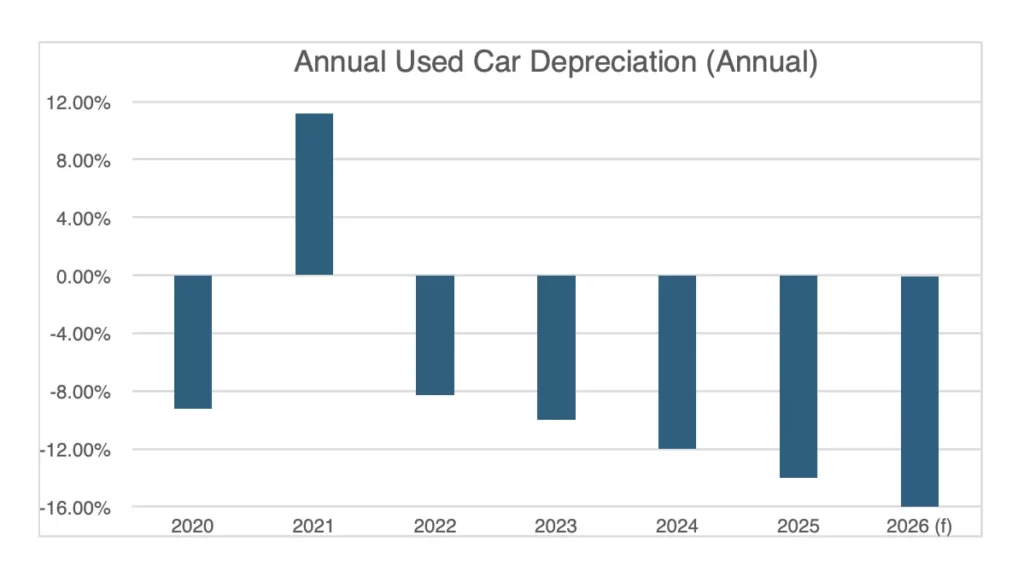

As per AlgoDriven, monthly depreciation is expected to rise from 1.2% to 1.3%, which translates into an annual compounded shift from 13.5% to 15%. On paper, that looks negligible. Compounded, it is anything but. The 2026 full market forecast: an additional AED 150+ million per year in depreciation-driven value erosion

Depreciation has doubled from 8% 2022 levels, and in 2026, becomes the single largest silent cost in the UAE car market. This is not driven by pricing mistakes. It is driven by time.

With respect to the total value of local car stock currently listed on DubiCars, in 2025, with an average monthly depreciation rate of 1.2%:

- Approximate value erosion of AED 46.32 million every month

- Over a year, compounded depreciation erased around AED 525 million in stock value

Moving into 2026, with monthly depreciation rising to 1.3%:

- Monthly value erosion increases to approximately AED 50.18 million, an 8.33% jump

- Annual compounded depreciation climbs to around AED 565 million, a 7.61% increase

That means nearly AED 40 million in additional value loss per year, driven purely by faster depreciation, and not by pricing mistakes or poor demand. If cars from the whole market are considered in the math, this number increases by more than 3x to approx AED 150 million a year — a massive number for the UAE car industry.

Segment-wise long-term depreciation trends as indicated by AutoData Middle East:

| Category | Avg Depreciation After 3 Years |

| European/Luxury | 45% – 60% |

| Niche/Speciality Cars | 35% – 50% |

| American SUVs | 30% – 40% |

| Japanese Cars | 15% – 25% |

| Chinese Cars | 25% – 35% |

| EVs | 30% – 45% |

What This Means for Dealers

In a market where depreciation runs at nearly 15% annually, holding stock is no longer neutral.

For a dealer holding 30–40 used cars:

- Margins can be erased within 7–8 months if vehicles do not sell

- Every additional week unsold increases financial risk

The implication is simple: If cars do not sell quickly, they become loss‑making.

The 2026 Playbook

To survive and grow in 2026, dealers must shift focus from margin maximisation to portfolio protection:

- Turn inventory in under 60 days

- Price realistically, earlier

- Treat response speed as a KPI

- Actively manage ageing stock

“In 2026, growth won’t come from just holding more cars. It will come from turning them faster.” – Craig Stevens.

Conclusion: Execution Over Excess

2025 proved that availability alone does not guarantee sales. Supply is high. Buyers are selective. Time now has a visible price.

The trends shaping the UAE car market are structural, not temporary. 2026 presents excellent growth opportunities for dealers, but success in 2026 will only favour those who respond faster, price smarter, turn stocks faster, and operate with discipline. The era of efficiency has begun.

FAQs

What changed in the UAE automotive market in 2025?

The UAE automotive market shifted from being supply-constrained to oversupplied. Vehicle availability increased faster than buyer urgency, leading to longer time-to-sale, softer pricing power, and rising depreciation across most segments.

Why is car depreciation increasing in 2026?

Depreciation is rising due to excess inventory, slower stock turnover, and aggressive pricing from new car manufacturers, especially Chinese brands. As cars sit longer before selling, time itself has become a direct financial cost.

How much value will cars lose in 2026?

The increase in monthly depreciation from 1.2% to 1.3% is expected to add over AED 150 million per year in incremental value erosion across the UAE automotive market.

Which car segments are most affected by rising depreciation?

Higher-value vehicles are most exposed, as premium cars carry larger absolute depreciation per month. Used cars, slower-moving European models, and ageing inventory face the highest financial risk.

How are Chinese cars impacting the UAE car market?

Chinese brands have rapidly expanded in the UAE, capturing 13% of total demand on DubiCars in 2025, up from 3% in 2024. Buyers increasingly choose new Chinese cars over used Japanese and European alternatives due to value, features, and availability.

Are EVs or hybrids performing better in the UAE market?

Hybrids have emerged as stronger performers for many buyers. While EV adoption is growing, hybrids offer electrification benefits without charging dependency, making them more practical for a broader segment of UAE consumers.

What should car dealers focus on to stay profitable in 2026?

Dealers should prioritise inventory turnover, realistic pricing, response speed, and active stock management. Growth in 2026 will come from execution and efficiency rather than simply carrying more cars.

A 2026 Forecast The UAE Auto Industry Can’t Ignore: An Extra AED 150 Million A Year In Value Erosion Executive Summary 2025 will be remembered as the year the UAE auto industry stopped being supply‑constrained — and started paying for